Cost is often a top concern when considering long-term care for yourself or your loved one. You want to ensure you receive the best care possible, but you also know you need to be financially realistic.

When working on financial planning as a caregiver for your loved one, you’ll want to consider several factors:

● How much care does your loved one need now, and how can you also plan for their future needs?

● Do you want to provide care yourself, or do you want to hire help to support you and your loved one?

● What assets does your loved one have for their support?

● What help is available to you and your loved one, financially speaking, to fund their care?

Let’s review some of the most important financial planning considerations around caring for your aging loved one.

You’ll have to consider how much of your loved one’s care you want to take on yourself. For physically and mentally independent parents, providing support in day-to-day activities may feel very manageable for you, both physically and financially.

You can work with your loved one directly for basic financial planning and budgeting that considers their income and assets and the financial responsibility they would like you to have over their lives.

However, as your loved one’s care needs increase, you will want to consider the cost increases and how you can plan for them.

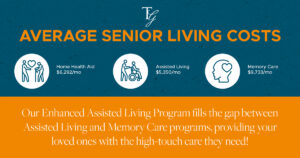

It’s common for people to want to age in place and to live out their lives in a place that feels like home. When considering in-home care, the average cost can be around $6292 a month for a home health aide or $5720 for homemaker services.

Assisted living communities like Tuscan Gardens of Palm Coast are a great option when more care is needed for your loved one while respecting their independence.

These communities offer readily available care and peace of mind that in-home care can’t always offer. The average cost nationwide tends to be $5350 a month.

Our unique Floreo neighborhood will provide a higher level of care than assisted living, and costs tend to be higher as a result. When planning long-term care for your loved one, finding in-between options that can increase support while maintaining their well-being and independence can be a great way to make aging more comfortable.

Depending on the costs associated with increased medical and physical care needs, Floreo™ will likely cost more than the $5350 national average for assisted living but offers a great in-between option for those who require more support but are not yet in need of memory care services.

Memory care is a care level for individuals who need to be supported more consistently throughout their day, including care for those with Alzheimer’s or dementia. Costs for memory care programs will reflect increased access to nursing services and expanded assistance when participating in activities so your loved one can continue living a rich life. For more advanced care needs than Floreo, costs can be up to $9733 a month.

As you review the costs associated with monthly support for your parents, you’ll want to bring in every resource you can to help defray costs and increase your budget so your loved one will have the best care possible. There are many resources available for you to consider, including:

This program was established to help support veterans and their families throughout their lives. If your parent or loved one received a VA pension and needs increased daily support for various reasons, they may qualify for the program. This program can help fund care throughout their lives, ensuring they can age in dignity.

Long-term care insurance is like any other insurance in that you pay monthly premiums and use the benefits when needed. This insurance coverage is useful before it’s needed, so it should be considered an important part of financial planning before assisted living is needed.

There are several types of long-term care insurance and not all help pay for senior living communities. For that reason, it’s important to fully understand what your loved one’s benefits cover when signing on to a long-term care insurance plan.

To help support your loved one, you can convert their life insurance policy to a long-term care provision. This process involves selling the life insurance benefit to a third party and receiving a set amount of funds to help with costs around long-term care options, including assisted living and memory care.

These programs tend to be set up to ensure your loved ones still qualify for Medicaid, and they provide more financial support than would be offered in a settlement on the policy, so they can be a good option when you’re looking to find funds to pay for long-term care.

The private health insurance market is vast and complex, so when you’re looking to use your loved one’s health insurance to support their cost of living, fully understanding their policy can be a great way to start. Connecting with their health insurance company and reading over policy documents can let you know exactly how much monthly support they can receive. However, it’s important to know that no coverage may be available except for medical needs. It is often the case that private health insurance only covers the same options as Medicare or Medicaid.

Medicare has some coverage for longer-term care but usually has a limit on the number of days per year and coverage that is limited to specific medical care. Generally, it also doesn’t cover help with your loved one’s day-to-day life.

Medicaid does cover more long-term care services than Medicare, including financial support for help with day-to-day activities. Medicaid typically has an income cap for services, so understanding where your loved one’s income fits into that picture can be an important first step toward getting help to pay for services.

Using your loved one’s personal assets, including Social Security income, retirement accounts, savings and investments, dividends, annuities, and home equity, is common to help pay for living expenses.

If this process feels overwhelming, working with a financial planner can help organize your loved one’s options and finances for you so you can make the best decision.

There are many things to consider aside from sources of money when it comes to financial planning, including how much oversight you have over your loved one’s financial and medical decisions and tax implications that can work in your favor.

One important consideration in your loved one’s plan for transitioning to an assisted living or memory care community in Palm Coast, Florida, with comfort and dignity will be who they want to make financial and medical decisions when they’re unable to do so. You will want to discuss power of attorney privileges with them and with a lawyer if you all decide that you should be granted the ability to make specific decisions on their care.

Power of attorney documents, or POAs, can be very specific or broad. They can have time limits and be limited to financial or medical decisions or include both. They can be written so your loved ones are protected and you can help them with decision-making. Financial and medical decisions can be easier when the responsibilities around them are laid out more completely, and power of attorney discussions can help you in that process.

When you are, financially speaking, the main caregiver for your parents for at least half of the year, there can be tax benefits you can claim. You may even be eligible to claim your parents as dependents. A few tax rules must be followed to make a claim properly, so discussing your situation with an accountant may be worth your time.

You may qualify to claim your parents as dependents if you:

● Have parents who make less than $5,040 each in income, not counting most Social Security income (depending on your parents’ other income, some SS income may be taxable)

● Spend at least $1 more than your parents’ income on their care and support.

● Provide majority support for them for at least half the year.

A solid understanding of the tax options for you and your parents can help you find the various tax benefits available to support their care. This extra money can help offset costs or increase the quality of care you can offer your parents. You want your parents to have the best, and simple tax planning can help make that possible.

At Tuscan Gardens of Palm Coast, we know the choice to seek out a senior living community for your loved one includes a lot of different decisions, including financial ones. We are ready to actively participate in your financial planning process, helping you understand what’s possible for you and your loved ones. Contact us today to schedule a tour of our beautiful community and discuss how we can help you plan for your parents or loved ones and your future.

Established in 2011, Tuscan Gardens of Palm Coast provides assisted living, Floreo, and memory care. It offers a vibrant lifestyle complete with Signature Dining, Signature Programs, and a Signature Experience grounded in celebrating family, culture, and heritage. Located in sunny Palm Coast, Tuscan Gardens of Palm Coast is a place your loved one can call home, with all of the comforts you would expect from a luxury senior living community in Florida.